Cost-cutting.

Now, CapEx has its advantages, of course.

In general, once the purchase cost has been incurred, there will be no others (apart from the recurring costs coming from maintenance and support services) and, in the long term, what is purchased on capital account will cost less than the rental of the same goods for an equivalent period of time.

However, OpEx can be more suitable in many situations. First of all, it’s not necessary to invest in advance a large amount of money, and this can become of fundamental importance when you have a small budget; moreover, the capital saved can be invested to finance long-term initiatives that can translate into higher profits.

For example, if you are launching a new UCaaS offering, even if you have sufficient spending capacity with the usual Capex approach, it would take a few months/years before reaching the financial break-even point; by purchasing the required resources with the subscription practice, instead, revenues could immediately cover costs.

Flexibility.

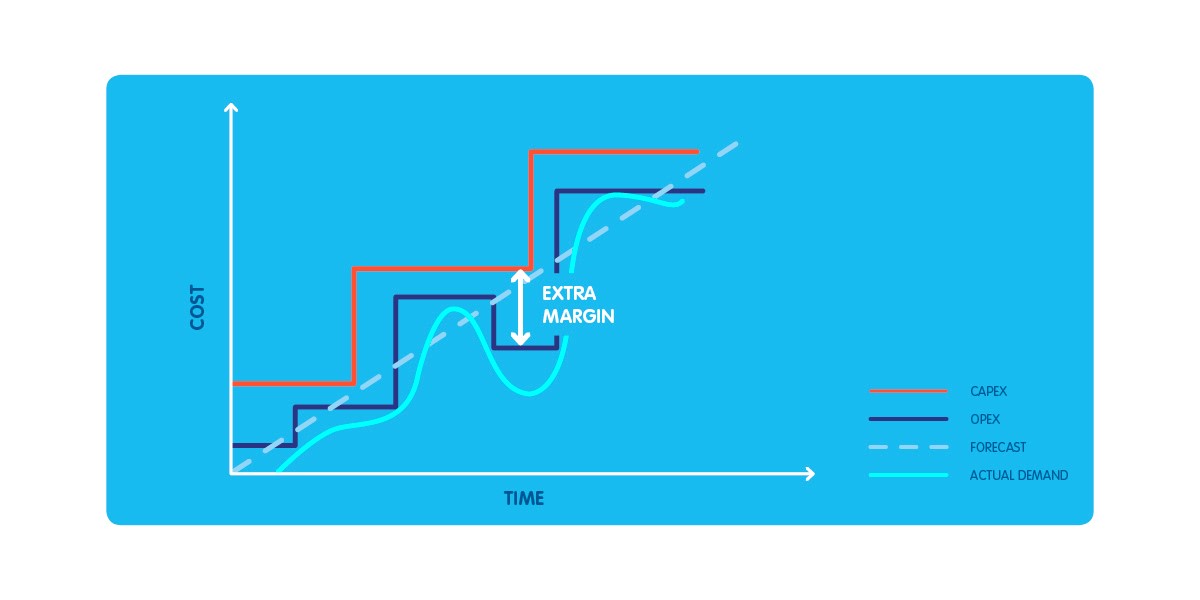

The OpEx model also offers flexibility. There is no need to invest large amounts today to make sure you meet requirements that will come out in two years; you can start with a small investment, expand the system when needed (or reduce it once the subscription period is over) or even stop or replace a service if it doesn’t offer what you need. You will never get stuck with the amortization of resources that you no longer use.

In a relatively new context such as that of UC as a Service, where the services paid by Customers depend on the effective users adoption and their needs may change over time, having the opportunity to modify and streamline purchasing costs accordingly can definitely become a competitive advantage, especially when launching a new offer on the market.

Predictability.

In addition, OpEx expense tends to be more predictable. Since you do not pay to buy an asset but for its use, the supplier must continue to provide a level of product/service performance based on the agreements made. If you buy a tangible asset and it breaks after the warranty expires, you will need to repair or replace it, incurring an unplanned cost. If, on the other hand, a contract is signed for the use of this asset, it’s normally the responsibility of the supplier to ensure the integrity and performance of the product. In many cases, you will not even have to pay for the upgrades: new versions of the product will be provided as part of the agreement, without having to buy a new one.

If we consider software applications, by purchasing in Opex mode there will be only one recurring cost, including maintenance, support, and updates, which will be fixed and foreseeable for the entire duration of the contract avoiding unplanned extra costs.

Other advantages.

It’s worth mentioning that t

the supplier that sells by subscription (regardless the deployment model which can be on-prem, hosted or Cloud based), having to constantly monitor the proper functioning of the product/service and the relative Customer satisfaction, can also suggest optimizations or report in advance problems that could occur in the specific way of using it.

In a software subscription, the licenses installed at the Customer site or at the Service Provider datacenter are always connected and registered with the Vendor that provided them, so that it can also control activations and deactivations according to the contractual terms.

This allows providing additional services such as proactive support, aimed at preventing inefficiencies and optimizing architectures and resources of the environment where it is installed.

Finally, there is a simpler and faster purchase and activation process, real-time visibility of the distribution of the licenses, and a centralized control for the expiry and renewals of the contracts.

Luca Isola

Luca Isola

0 commenti